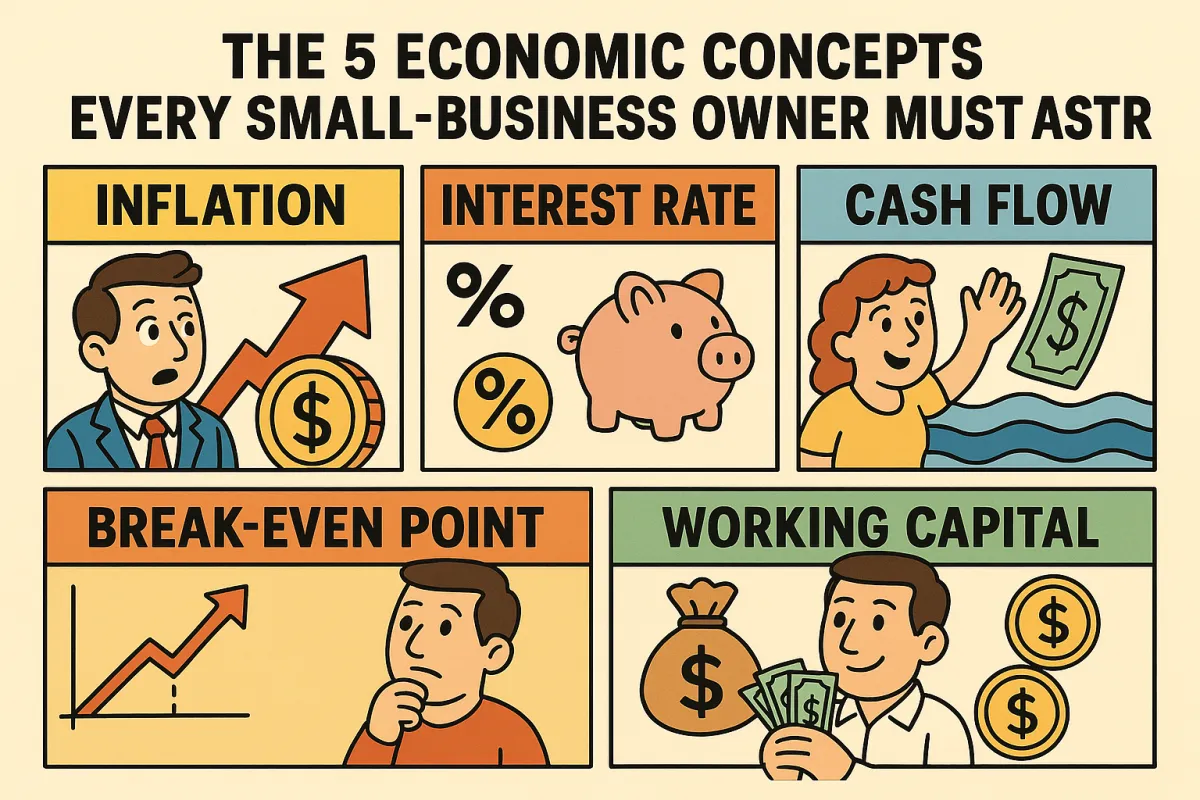

The 5 Economic Concepts Every Small-Business Owner Must Master

The 5 Economic Concepts Every Small-Business Owner Must Master

Last year, Phoenix maker Desert Home Décor was paying 3 % on a line of credit—until the Federal Reserve pushed rates to 4¼-4½ %.¹ Facing a $7 000 spike in annual interest, the founder read Harvard Business Review’s “Adapt Your Strategy to Higher Interest Rates” and switched to cash-on-delivery terms with suppliers.² Savings kept her afloat and proved a simple truth: knowing a few economic basics can keep your doors open.

The U.S. Bureau of Labor Statistics shows consumer prices still rising 2.4 % year-over-year,³ while the SBA estimates nearly half of new firms close within five years.⁴ Ignoring economics is a luxury most owners can’t afford.

Below are five essentials, plain-spoken and action-ready:

Common missteps

Chasing growth before reaching break-even.

Fixating on revenue but ignoring cash flow timing.

Borrowing at variable rates without stress-testing higher payments.

Mastering these five terms isn’t an MBA—it's survival gear. Desert Home Décor used them to renegotiate credit, raise prices 4 %, and secure a 60-day cash cushion within one quarter.

Which concept will you tackle first—updating your break-even math or forecasting next month’s cash flow? Share your choice in the comments and spark a smarter money conversation.

Sources

Federal Reserve, H.15 Selected Interest Rates, June 24 2025. federalreserve.gov

A. Muhammed et al., Harvard Business Review, “Adapt Your Strategy to Higher Interest Rates,” Mar 2024. hbr.org

Bureau of Labor Statistics, Consumer Price Index Summary, May 2025. bls.gov

SBA Office of Advocacy, Small Business Facts, 2025 update. advocacy.sba.gov

MIT Sloan Finance Faculty, “Financial Literacy for Entrepreneurs,” 2024 briefing. mitsloan.mit.edu